Get the free prosperity bank personal statement

Show details

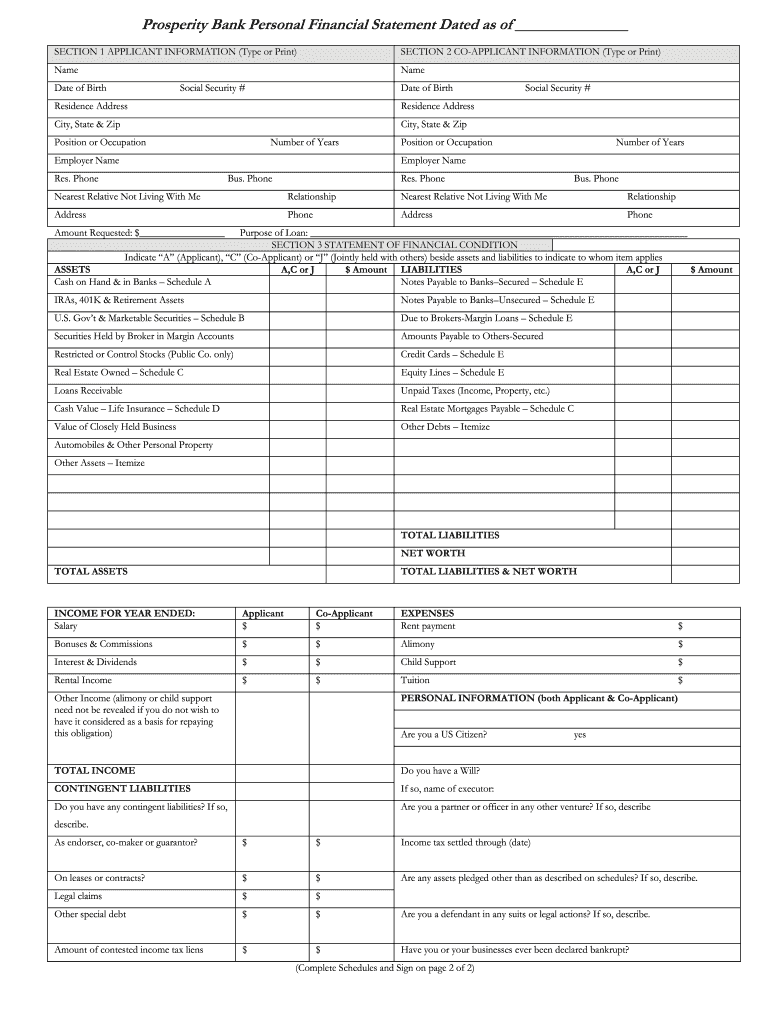

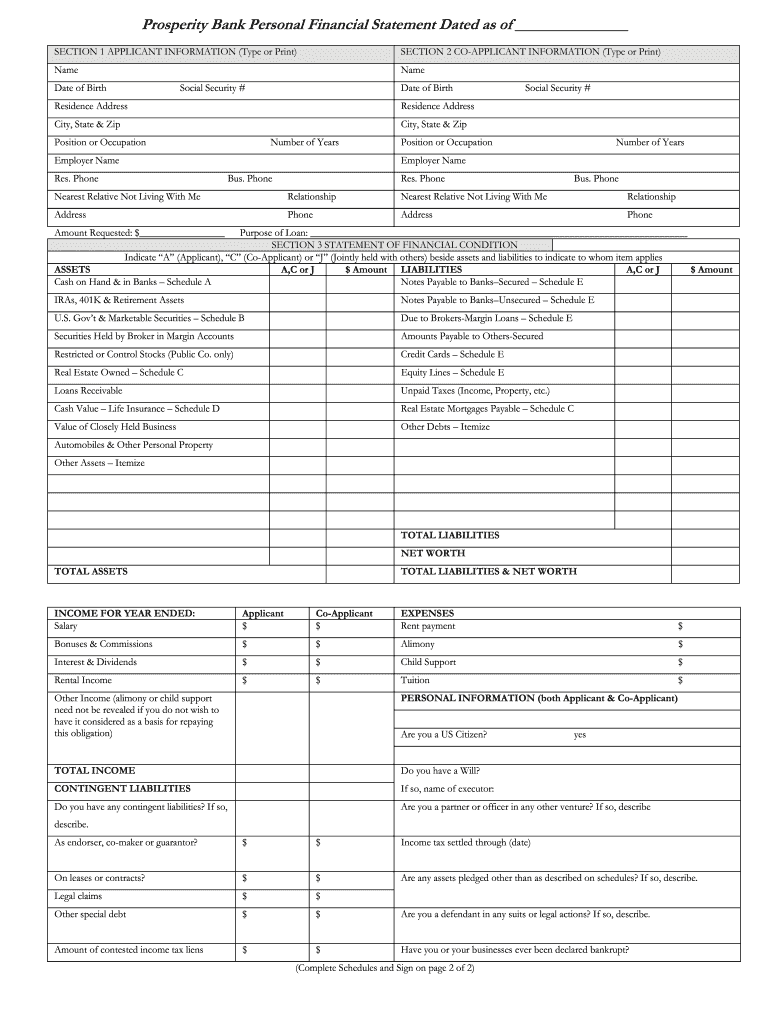

Prosperity Bank Personal Financial Statement Dated as of SECTION 1 APPLICANT INFORMATION (Type or Print) SECTION 2 CO-APPLICANT INFORMATION (Type or Print) Name Date of Birth Name Social Security

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign prosperity bank statement pdf form

Edit your direct deposit form prosperity bank form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your prosperity personal financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit prosperity bank financial statements online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit prosperity statement bank form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out statement prosperity bank form

How to fill out Prosperity Bank Personal Financial Statement

01

Gather your personal information including name, address, and contact details.

02

List all your assets, including bank accounts, real estate, investments, and personal property.

03

Quantify your liabilities by including all debts such as loans, credit cards, and mortgages.

04

Calculate your net worth by subtracting total liabilities from total assets.

05

Provide details about your income sources, including employment, investments, and any other income.

06

Include any additional information that may support your financial statement, such as explanations for any debts or unusual income.

Who needs Prosperity Bank Personal Financial Statement?

01

Individuals applying for loans or credit from Prosperity Bank.

02

Business owners seeking business loans or lines of credit.

03

Anyone needing to assess their financial health.

04

Individuals involved in estate planning or financial planning.

Fill

prosperity bank statements

: Try Risk Free

People Also Ask about bank prosperity statement

How to do a direct deposit form?

How To Set Up Direct Deposit Fill out the direct deposit form. Include your account information. Deposit amount. Attach a voided check or deposit slip. Submit the form.

Can you get a direct deposit form online?

Ask for a written or online direct deposit form. If that isn't available, ask your bank or credit union for one. We've included a list of forms from top banks, including the Capital One and Bank of America direct deposit forms. NerdWallet's ratings are determined by our editorial team.

Does Prosperity Bank have direct deposit?

Simply enroll in eStatements or direct deposit. You'll receive imaged check statements and won't have to pay the monthly maintenance fee.

What do I need to get a direct deposit form from my bank?

What information do I need to provide in order to set up direct deposit? Your employer or depositor's name and address. Your Employee ID or account number with depositor. Your account number. Your routing/ABA number.

How do I make a direct deposit form?

Get a direct deposit form from your employer. Fill in account information. Confirm the deposit amount. Attach a voided check or deposit slip, if required. Submit the form.

Can my bank give me a direct deposit form?

Direct deposit authorization forms are available online, usually through your payee's online account access, or from a local bank branch.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my prosperity bank statement online in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign prosperity bank financial statement and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send prosperity bank personal to be eSigned by others?

When your prosperity bank direct deposit form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for signing my statement bank prosperity in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your bank statement prosperity right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is Prosperity Bank Personal Financial Statement?

The Prosperity Bank Personal Financial Statement is a financial document that provides an overview of an individual's financial position, including assets, liabilities, income, and expenses.

Who is required to file Prosperity Bank Personal Financial Statement?

Individuals seeking loans, credit, or financial assessments from Prosperity Bank may be required to file a Personal Financial Statement.

How to fill out Prosperity Bank Personal Financial Statement?

To fill out the Prosperity Bank Personal Financial Statement, individuals should provide accurate details about their personal assets, liabilities, income sources, and monthly expenses, ensuring all information is up to date.

What is the purpose of Prosperity Bank Personal Financial Statement?

The purpose of the Prosperity Bank Personal Financial Statement is to evaluate an individual's financial health and creditworthiness, aiding the bank in making informed lending decisions.

What information must be reported on Prosperity Bank Personal Financial Statement?

The Prosperity Bank Personal Financial Statement requires reporting of personal identification details, a comprehensive list of assets and liabilities, income sources, and regular expenses.

Fill out your Prosperity Bank Personal Financial Statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Prosperity Bank Statement is not the form you're looking for?Search for another form here.

Keywords relevant to prosperity bank tax documents

Related to direct deposit prosperity bank

If you believe that this page should be taken down, please follow our DMCA take down process

here

.